The fifth chapter of the UEFA Club Footballing Landscape was about (foreign) club ownership.

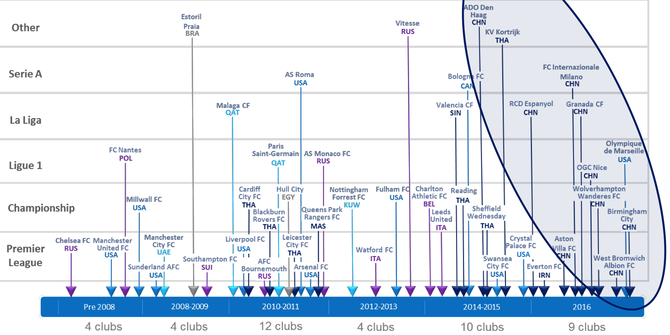

Forty-four clubs in major European leagues are now under foreign ownership, by owners of 18 different nationalities.

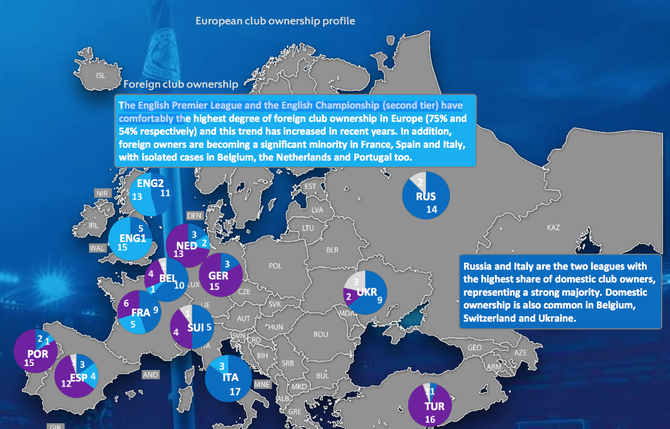

Foreign ownership is still centered in England, where more than half of the clubs in the top two leagues now have foreign owners.

2016 was the most active year for foreign club takeovers, with ten new acquisitions by November, including eight new Chinese owners.

Foreign ownership increased over recent years predominantly in England (first and second tier) (75 and 54%) respectively. However, an opposite trend was observed in France, Spain and Italy.

More than three-quarters of clubs in Germany, Portugal and Turkey do not have controlling parties as the clubs are predominantly associations. This ownership structure is also quite dominant in

the Netherlands and Spain with some cases also seen in Belgium, France, Switzerland and Ukraine. Interestingly, Russia and Italy have the highest share of domestic club owners.

Where are the owners coming from?

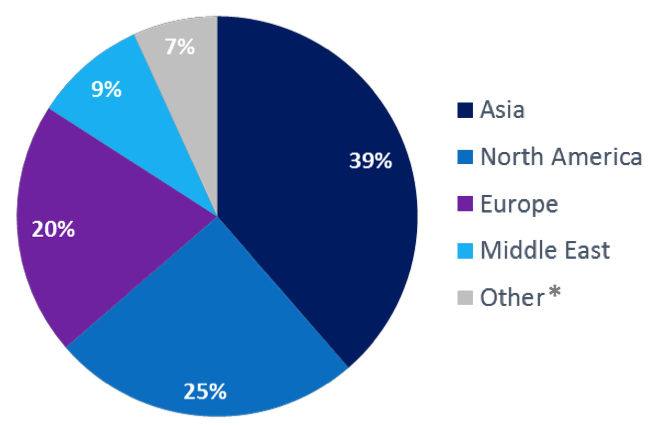

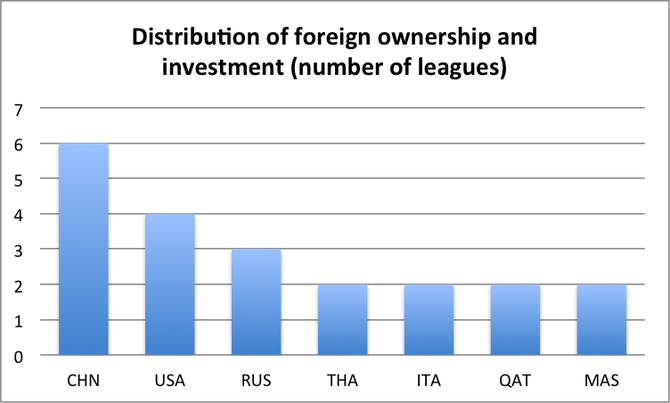

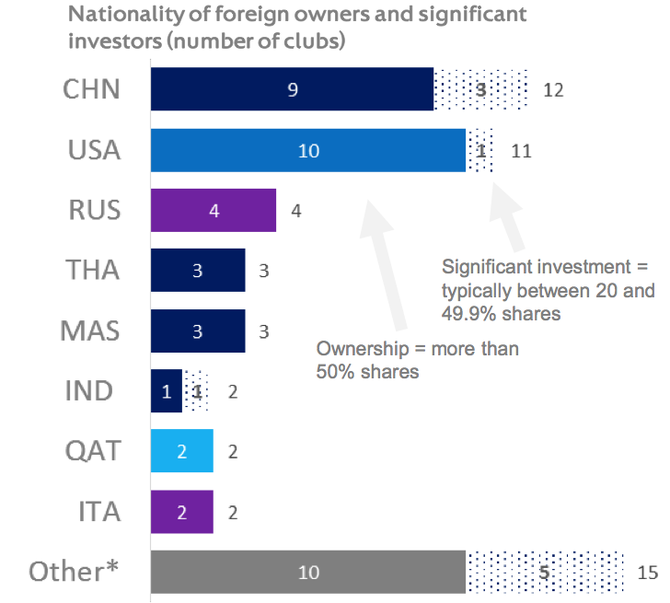

The Asian region provides the largest source of foreign investment, with 17 clubs under majority foreign ownership. As of November 2016, nine clubs are under Chinese control and Chinese owners are present in six different leagues, making them the most widespread of any nationality. In addition, six clubs have received significant non-controlling Chinese investments.

North America, and more specifically the USA, is the second largest source of investment in European clubs. As of November 2016, 10 clubs across 4 different leagues (the English Premier League and Championship, Italy’s Serie A and most recently the French Ligue 1 ) are under American ownership.

A total of 20% of total foreign investment comes directly from within Europe. Meaning European investors who either own or invest in a European league club of a different nationality. The two most prominent nationalities in this investor groups are Russian and Italian. As of November 2016 there are four clubs owned by Russian investors in three leagues outside Russia (Ligue 1, EPL & Eredivise) and Italian ownership in Englands top two leagues.

The largest share of foreign ownership in European club football comes from Asia. As the timeline shows, Asian ownership has mainly emerged over the last season (2015/16). Of the ten new owners that invested in clubs in Europe’s top leagues in 2016, eight came from China. It is also worth noting that Chinese investors have invested in clubs in five different leagues in the first 11 months of 2016 (shaded area, additionally, AC Milans change in ownership was not confirmed by the time of release of this document).

The second largest source of foreign ownership comes from North America, mainly the USA. Of the 13 clubs in the English Premier League, six are under American ownership. Americans were the first foreign owners to come from a continent other than Europe and their influx has been fairly consistent over time.

Nine foreign owners are European. These owners come from five different countries, and four of them are Russian. In this sample of clubs from 13 leagues, Russian investment has also accounted for

the longest- standing active ownership (since 2003).

The fourth and smallest source of foreign ownership is the Middle East, with four clubs under Middle Eastern ownership. These four clubs come from four different leagues: the English Premier

League, the English Championship, the French Ligue 1 and Spain’s La Liga.

Reference

http://www.uefa.org/MultimediaFiles/Download/Tech/uefaorg/General/02/42/27/91/2422791_DOWNLOAD.pdf

Footballscience.net

Footballscience.net